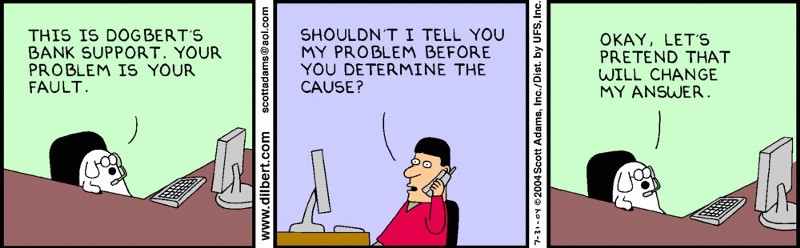

Forced arbitration is unfair and abusive. Companies don't timely pay their fees. They drag out what would otherwise be quickly resolved court claims. The AAA doesn't administer impartially. Arbitrators with conflicts are appointed. The rules are optional. There's no accountability mechanism for the arbitration firms or the arbitrators. And on and on. I could write a book.

All that being said, I beat Citibank and its Big Law firm in forced arbitration and so can you.

It started with credit damage.

I applied in-person for a car loan and was denied. The credit union supervisor told me my credit score was in the 500s. Eeeeek, what?! I was shocked and embarrassed. I had safeguards against this. What went wrong?

I rushed home and pulled my credit report to see that Citibank had reported me as 30-days late twice in the last few months. Only, I had not received any notices, calls, emails... nothing. In addition, the account that was reported as late was setup to be paid from a bank account with an overdraft protection line of credit (Checking Plus). The line of credit had an untapped limit of $4,200.

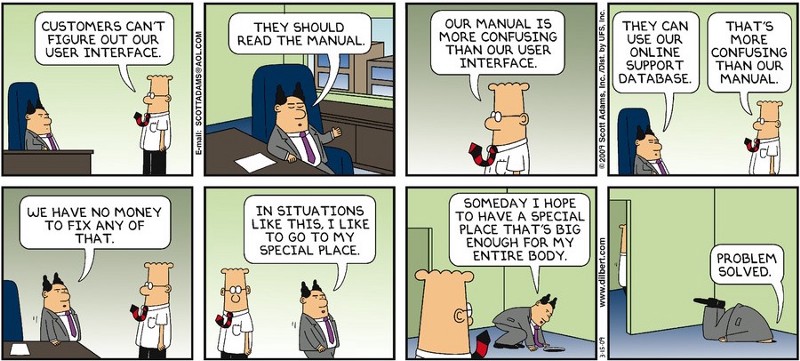

When I tried to log on to Citibank's website to see what went awry, it said my account was blocked and gave me a phone number to call. So I called. I was told that because I had not activated a new debit card, my online access to statements and notices was blocked. In order to remove the block and see what happened, I had to wait for a new debit card and activate it...

What in the World (WITW) #1: Why would you tie statements and notices to debit card use? It's a checking account. It can be used without a debit card. At least revert to mailed statements and notices.

Two weeks later, I received my new debit card and logged on. I saw that a few months prior, a recurring debit card purchase had taken my account balance to $-10.85.

Okaaaaaaay. Why didn't my overdraft protection line of credit kick in?

My line of credit agreement and Citibank's marketing all say, without condition, that money will be transferred in $100 increments from my line of credit to my bank account whenever my account is overdrawn. Therefore, I expected $100 to have been transferred when my bank account balance went below zero dollars. My balance should have gone from $-10.85 to $89.15.

Yes, I would have been charged a transfer fee. Yes, the line of credit had a high interest rate. Yes, I agreed to that. It was cheaper than a missed payment or a bounced check or damaged credit. It was why I established the account...

So, because my account was overdrawn to $-10.85, Citibank had denied a payment citing insufficient funds. This missed payment was then reported as late on my credit report.

What!?

Then it happened again!

Whaaaaaaaaaaat!?!?

WITW #2: Why would an overdraft protection line of credit not protect a customer from being overdrawn!? WITW is going on!?

At this point I was thoroughly confused. What I saw in my statements, what my agreement said, what Citibank's marketing said, what Citibank's phone reps told me, and what my understanding was, were in conflict.

As far as I could tell, Citibank misadministered my account. However, everyone I spoke to assured me that it did not and that it was all in my agreements. Only it wasn't. I couldn't find anything that supported what Citibank did.

Still having damaged credit, I began writing Citibank. I started by being deferential. I assumed that there must be some agreement that I missed that everyone else was referring to. So I requested copies.

The copies I received were substantially the same as what I already had. So I asked again. And again, I received the same thing.

Nobody could provide me an agreement or disclosure that justified Citibank's actions.

At my wits end, I demanded to speak to a manager. The manager told me: "Oh, we don't transfer overdraft protection until your account is overdrawn by $25 or more." "Ummmmmmm... okay. That's material information, where is it disclosed?" I replied. Again, he said to me, "Oh, it's in your agreement. I'll send you a copy."

So I patiently waited thinking I'd finally get the agreement that I'd been seeking. Nope. It was the same one I'd been sent three times already! And there was absolutely nothing in it about any $25 threshold.

At this point, I was pissed. Citibank was lying to me and wasting my time.

WITW #3: Does Citibank not know what's in its own agreements!? Does it not understand how its arbitrary threshold can harm its customers? Does it even care?

Armed with this new information, I continued to write Citibank and demand copies of whatever disclosures permitted its actions or a correction to my credit reports.

I was ignored. I received a few form letter responses but never a thoughtful investigation. And my credit score was still in the dumps...

Out of options, I reviewed my agreement to find a forced arbitration agreement. It said I could file in small claims court in lieu of arbitration to resolve my dispute.

I filed a small claim in January 2012.

WITW #4: It takes all of 30 seconds to fix my credit and defuse my inquiry. Where are the competent managers? Where is the escalation? Who is thinking about the bottom line?

That's it for now. I'll file part two in the coming weeks. This will likely end up being four or five parts.

If you want to read ahead, check out my forum posts. Here are my cases:

1. https://levelplayingfield.io/case/27688

2. https://levelplayingfield.io/case/33089

This my personal story. Any opinions are my own. This is not legal advice.

I'm far from the only one with a story to tell, please tell us yours and read others in the forum.

We formed Level Playing Field 501(c)(3) to help you. We're barely getting started. To support our work, the continued build out and maintenance of the arbitration database and community, please support us on Patreon (even $1 a month helps). Perhaps even more importantly, contribute your knowledge and experience to the forum.